GAME OVER …. ALL THESE FINANCIAL CRIMES MUST BE CONFRONTED AND SPECIAL PROSECUTORS APPOINTED ….. The American People Have a RIGHT TO KNOW

JIGS UP Deutsche JP Morgan Chase Danske Credit Suisse JIGS UP

Deutsche Bank’s

Running Tab of Investigations

https://www.youtube.com/watch?v=ksZSl4T0WNs

VANISHING TRILLIONS Everything is Rigged

TRUMP needs to PROSECUTE THE BANKSTERS especially the One’s that FINANCE HIM ” Make America MOB Again “

HOCUS POCUS DOJ FBI Racketeering

The BANKSTERS Own the White House and DOJ…

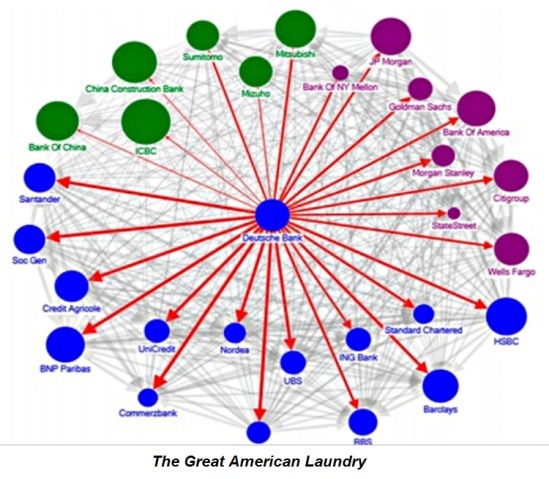

THE MASTER GRAND GLOBAL BANK JOB The Financial System RIGGING

The Great British Mortgage Swindle

Because Judson Witham IS NOT Crazy

The TRIAD and Martin Harris’s Hat … SEER This Joe Smith … The Mormon MAFIA and the Deep State

Former US Secret Service Agent RICK WILLIAMS ….. Conoco Phillips Oil WOODLANDS TEXAS

I’ll Take Real Estate Schemes for Trillions Alex ……. http://www.bing.com/search?q=Real+Estate++Fraud++Trillions+Looted

FBI and DOJ with Secret Service are 100% CORRUPT AS ALL HELL …..https://www.bing.com/search…

UBS HSBC Mortgage Fraud Money Laundering – Bing

You Know Witham makes very very good points

Dear President Trump ….. DAN SCAVINO lets talk DIRT DEALING and MONEY LAUNDERING https://www.bing.com/search?q=Money%20Laundering%20Bank%20Looting%20Real%20Estate%20Speculation%20Trillions%20Looted&qs=ds&form=QBRE

ENJOY THE SHOW

Real Estate Fraud Trillions Looted Bank Panic http://www.bing.com/search?q=Real+Estate++Fraud++Trillions+Looted+Bank+Panic&qs=n&form=QBLH&pq=real+estate+fraud+trillions+looted+bank+panic&sc=0-0&sp=-1&sk=&cvid=693209785FB34202B29D11883C29005C

From Gulf Manor Airport and the CIA to the 26th Floor of the Houstonian Estates … 33,000 Destroyed Emails and more than 1.5 Million Lay Dead … This is the ACTUAL STORY … The TRUTH

The Rigged LIBOR, They Rigged the Gold Markets, They Rigged the Mortgage Markets, They LIED on a Grand Scale to SELL Their Liars NO Down Payment 125% Funding LIARS LOANS and They Have Rigged MONEY LAUNDERING ON A GLOBAL SCALE. Laundering Looting and Off Shoring TRILLIONS …. WAY BEYOND THE PANAMA PAPERS.

Gerald Cugno Deutsche Bank JP Morgan Chase Credit Suisse

The Largest Financial SWINDLES and CRIMES in History

IT’s A GLOBAL CRIME SCENE

Funded in VERY LARGE PART by Laundered Money

From: SwampFox <notjuris@gmail.com>

To: FOIA <FOIA@fhfaoig.gov>

Cc: “Ann Pellegrino, Esq.” <aladyjustice@aol.com>, Jean Allan <jeanelizallan@gmail.com>, jeffandmary@ozarkopathy.org, billie powers <powersbillie@yahoo.com>, Kim Hogan <kdhogan@ymail.com>

Bcc:

Date: Fri, 22 Mar 2019 08:41:36 -0400

Subject: CLARIFICATION Re: 2019-FOIA-00009

Dear Sheila Peden, FHFA FOIA Department, HUD and CFPB, FBI, DOJ ,

FinCen,

Greetings:

The Funding Sources for the EASY CREDIT SCAMMING of 125% Predatory Liars

Loans of Cugno and the others all were perpetrated by Them acting

together. *The information is for the ENTIRE Group of SCAMMERS.* The

Baiting of Consumers done with ZERO DOWN 125% Subprime Predatory

EASY CREDIT LOANS directly involves Duetsche Danske JP Morgan Chase and

these PERPETRATORS Networks of International Racketeering involving VAST

MONEY LAUNDERING. The REALITY of BILLIONS in Fines levied against

Deutsche , Danske, Etc Et Al Banks and JP Morgan is very simple …. *From

A to Z the WHOLE GANG premeditated all the Deception and Lies. YES I

insist the information be released on the WHOLE GANG / MAFIA involving

these PERPETRATORS.*

These SAME DOGS fixed the LIBOR and GOLD MARKETS and have been fined many

BILLIONS for Lies, Fraud and Scheming against the US Government.

Laundering Hundreds of Billions of Dollars is done through SUBPRIME

LENDING …. YES SPECIFICALLY *I am demanding all the Records,

Investigations and Information on the WHOLE GANG. *

* There were many BILLIONS in Fines levied and VAST AMOUNTS of Money

Laundering …. The Real Estate Racket and the Money Laundering are

directly connected.

<https://www.bing.com/search?q=churning%20money%20laundering%20predatory%20mortgages&qs=ds&form=QBRE>*

*SEE ….. **https://www.bing.com/search?q=churning%20money%20laundering%20predatory%20mortgages&qs=ds&form=QBRE

<https://www.bing.com/search?q=churning%20money%20laundering%20predatory%20mortgages&qs=ds&form=QBRE>*

*THANKS*

*J. Witham*

*Whistle Blower*

*PLEASE UNDERSTAND They Looted the ENTIRE PLANET and Fixed the World

REALTY MARKETS and RIGGED The Mortgage Industry for DECADES to Come.*

On Thu, Mar 21, 2019 at 10:47 AM FOIA <FOIA@fhfaoig.gov> wrote:

> Mr. Witham,

> I want to make certain that I understand your FOIA request.

>

> Are you looking only for documents pertaining to Gerald Cugno and Premier,

> Paramount and Pioneer MORTGAGE BROKERS or do you want all of these

> documents for JP Morgan Chase, Deutsche Bank, Credit Suisse and Select

> Portfolio Services, as well?

>

> Thank you,

>

> Sheila Peden

>

> Acting FOIA Officer

>

> CAUTION: The information contained in this message, including any

> attached files, is intended only for the recipient(s) to whom it is

> addressed. This message may contain information that is sensitive,

> confidential, and/or protected by the attorney work product, law

> enforcement, deliberative process, or other privilege. Any review,

> retransmission, dissemination or other use of, or taking of any action in

> reliance upon, this information by persons or entities other than the

> intended recipient(s) is strictly prohibited. If you have received this

> message in error, please contact the sender immediately and delete the

> material from your computer.

>

> *NON-PUBLIC*

>

> *From:* FOIA

> *Sent:* Thursday, March 21, 2019 7:34 AM

> *To:* SwampFox <notjuris@gmail.com>; FOIA <FOIA@fhfaoig.GOV>

> *Subject:* Acknowledgement Letter

>

>

> Dear Mr. Witham,

>

> Attached please find correspondence regarding your FOIA request.

>

> Sincerely,

> Sheila Peden

>

> Acting FOIA Officer

>

> CAUTION: The information contained in this message, including any

> attached files, is intended only for the recipient(s) to whom it is

> addressed. This message may contain information that is sensitive,

> confidential, and/or protected by the attorney work product, law

> enforcement, deliberative process, or other privilege. Any review,

> retransmission, dissemination or other use of, or taking of any action in

> reliance upon, this information by persons or entities other than the

> intended recipient(s) is strictly prohibited. If you have received this

> message in er

—– Message truncated —–

These Perpetrators Fund LOTS of Politicians and Their Campaigns IT’s a GIANT Campaign Finance ORGY a GREAT BIG DAISY CHAIN

|

1:11 PM (11 minutes ago) | |||

|

||||

The BANKSTERS OPERATE IN SECRET WITH THEIR POLITICAL PROTECTION. The SECRET BANKING ACTIVITIES in the So Called United States is a VAST ABUSE Against the People of the So Called United States. SECRET BANKING …. COVER UP ….. WHITE WASH and SWEEP UNDER THE RUG ….. YES ABSOLUTELY COURT IS THE NEXT STOP. Trillions in Bail Outs and PEANUTS in FINES for ll the WELL CONNECTED and Those That BUY INFLUENCE. What a COMPLETE RACKET.

TOTAL SECRECY IN CRIMINAL BANKING ….. Protected and Sheilded from PUBLIC SCRUTINY ….. BACK IN THE USSR …… WHAT A RACKET

Son of the Swamp Fox

Judson Witham

On Fri, Mar 22, 2019 at 9:36 AM Orlin, Lindsay <lindsay.orlin@fincen.gov> wrote:

Mr. Witham: attached is a signed copy by the Deputy Director on the FOIA Appeal under goFOIA 2019-02-146

Thank you

Lindsay Orlin

Legal Program Specialist

Office of Chief Counsel

Deutsche Banksters the Rap Sheet that Never Ends

Deutsche and Danske …. UBS, HSBC, CITI, JP Morgan, Chase, Wells FRAUDO ….. DIRT DEALING and MONEY LAUNDERING 101

How the World’s Leading Banks Help Launder $2 Trillion a Year …https://news.bitcoin.com/how-the-worlds-leading-banks-help-launder-2-trillion-a-year/

Deutsche Bank, BofA, JPM Drawn into Danske Money Laundering …

Bank Crimes Pay: Under the Thumb of the Global Financial Mafiocracy

How a big US bank laundered billions from Mexico’s … – The Guardian

Banks are Better than Bitcoin (When It Comes to Money Laundering)

Lawsuit Reveals Deutsche Bank Probe of Ties to Russian Ministers …

Deutsche Bank Is Said to Be Drawn Deeper Into Danske Scandal …

Danske: anatomy of a money laundering scandal | Financial Times

It seems that DON MAFIA’s Financiers are as DIRTY as They Come

https://www.cnbc.com/2019/03/19/deutsche-bank-loaned-2-billion-to-donald-trump-over-two-decades-nyt.html

|

7:11 PM (2 hours ago) |

|

||

|

||||

Cugno and the others all acted together. The information is for the ENTIRE Group of SCAMMERS. The Baiting of Consumers done with ZERO DOWN 125% Subprime Predatory EASY CREDIT Racketeering. The REALITY of BILLIONS in Fines against Deutsche Bank and JP Morgan is very simple …. From A to Z the WHOLE GANG premeditated all the Deception and Lies. YES I insist the information be released on the WHOLE GANG / MAFIA involving these PERPETRATORS.

OVER STATED ASSETS ….. LIARS LOANS

Feb 15, 2013 – enhancing gains on mortgage loans, mortgage backed securities (MBSs), and … of organizations, such as in the manipulation of the London Interbank. Offer Rate (Libor). ….. banks pushed their origination units to fund more subprime loans with ….. wire fraud, mail fraud or money laundering. …… Fool’s Gold.

It is my contention that this includes the relationship between subprime … It has been argued that any loan could be categorised as predatory lending where the …. mail and wire fraud, money laundering … and other related financial crimes …. of a series of record fines due to the LIBOR, FOREX and gold rigging scandals.

predatory lending can be classified as a ‘related factor’ that contributed towards … increased profit these institutions provided subprime mortgages with … banking Acts, bribery, fraud, tax evasion, money laundering, insider trading, predatory ….. manipulation of Libor benchmark interest rates’, 6 February 2013, available from.

Automatic reply: [EXT] Gerald Cugno Deutsche Bank JP Morgan Chase Credit Suisse

| FHFA Finance Administration | FOIA Demand |

|

10:30 AM (2 hours ago) | |||

|

||||

Thank you for contacting the Federal Housing Finance Agency’s (FHFA) Freedom of Information Act (FOIA) Office. This is an automated message to confirm that your email has been received. All emails will be responded to as soon as possible.

If you are submitting a FOIA request, you will receive a written acknowledgement of receipt once your request has been reviewed.

Looting Laundering and Churning TRILLIONS in Real Estate Mortgage and Securitization FRAUDS

| FOIA To Senate and Congress Financial | and Banking / Intelligence Committees |

|

10:30 AM (1 minute ago) | |||

|

||||

Dear FHFA,, FinCen, HUD, FHA and DOJ / FBI Etc Et Al,

Gerald Cugno of Tampa Florida ( New Jersey ) AKA Premier, Paramount and Pioneer MORTGAGE BROKERS had all 900 Offices Shutter because of Mortgage Fraud Practices and JP Morgan Chase, Deutsche Bank, Credit Suisse and Select Portfolio Services have paid UNTOLD BILLIONS in Fines and Penalties for all types of Deceptions, Concealments, Frauds and Scams associated with Their Mortgage Industry and Securitization Practices.

This FOIA is made IN THE PUBLIC INTEREST and Said Information Obtained is for FREE DISSEMINATION to the Victims of the Above Corporations and Companies CRIME SPREE. I request a FEE WAIVER as Such in the Pubic Interests.

Under FOIA I request,

- A Master List of Records, Files and Reports on the Fraudulent and Abusive Consumer Practices of the Above Named Corporations and Companies

- The Reports Records, Files and Investigation and Court Records associated with ALL Enforcement Actions FHFA have been involved in with DOJ, SEC, FBI, FinCen, HUD, FHA, OCC or and other National Law Enforcement Agencies.

- All reports and files, records provided to the US Congress and Senate’s Financial Services Committees and Banking Committees associated with the AFOREMENTIONED Perpetrators.

In Closing, the American People have a RIGHT to know how so much Money is LOOTED and LAUNDERED by these BANKSTERS. The American People have a RIGHT to a Full Explanation.

Judson Witham

Legacy Trust Media

|

10:31 AM (0 minutes ago) | |||

|

||||

Thank you for contacting the Federal Housing Finance Agency Office of Inspector General’s (FHFA-OIG) Freedom of Information Act (FOIA) Office. This is an automated message to confirm that your email has been received. FHFA-OIG will respond to your email in accordance with applicable legal requirements. For an email which includes a FOIA request, FHFA-OIG will acknowledge receipt of the email once the FOIA request has been reviewed.

ENOUGH IS ENOUGH Time to Produce and Open ALL The Files, Reports and Records

Churning – Laundering Money and the Subprime Daisy Chain …

Real Estate Fraud Bank Looting Subprime JUDSON WITHAM – Bing. … The central players in the Deutsche Bank money laundering scandal, which gained media attention in late 2016 include: … Land Fraud, Bank Looting, … pq=trillions+looted … The Subprime Swindle and the …

From 2014

….. Just these three legal debacles alone have cost the bank nearly $23 billion in fines, restitution and trading losses in the last year. Professor Black says, “CEO Jamie Dimon has presided over the largest financial crime spree in world history. . . . It depends on how you count it, but it is more than a dozen, and more in the range of 15 major felonies that either the United States investigators have found, state investigators have found or foreign governments have found.” The Professor goes on to say, “JP Morgan’s frauds are epic in scale, unprecedented in world history. . . in these $23 billion we’re talking about, these are frauds that made Jamie Dimon and other senior officers incredibly wealthy by creating fictional income that led to very real bonuses.” …..

According to the Indictment, the defendants used three companies owned by the Mozambican government (including companies named Proindicus and EMATUM) to obtain more than $2 billion in state-backed loans to fund supposed projects meant to benefit the country of Mozambique. The companies were to perform coastal surveillance, tuna fishing, and shipyard projects. Prosecutors allege that the defendants instead “created maritime projects that conducted little to no legitimate business activity to funnel at least $200 million in bribes and kickbacks to themselves, Mozambican government officials and others.”

Deutsche, Credit Agricole, Credit Suisse charged by EU over alleged bond cartel

BRUSSELS/FRANKFURT (Reuters) – Deutsche Bank, Credit Agricole, Credit Suisse and another bank have been charged by European Union…

VIDEO: Adam Schiff says Mueller investigation may be …

Deutsche Bank provided loans to Trump in the 1990s after U.S. lenders opted against it following a flurry of bankruptcies. “If the special counsel hasn’t subpoenaed Deutsche Bank, he can’t be doing much of a money laundering investigation,” Schiff said.

House Democrats zero in on Deutsche Bank | WGNO

Jan 24, 2019 · McHenry sent a letter to Deutsche Bank CEO Christian Sewing on Thursday initiating his own investigation into the bank’s anti-money laundering operations, including with Russia.

Deutsche Bank Questioned by GOP Lawmaker About Money …

(Bloomberg) — Deutsche Bank AG’s chief executive officer is being questioned by a key Republican lawmaker over what the company is doing to boost money–launderingsafeguards amid reports that its U.S. unit may have been a key conduit for billions of dollars of dirty money. Representative Patrick McHenry…

-

Deutsche Bank Faces Growing U.S Scrutiny Over Money Laundering

https://www.bloombergquint.com/politics/deutsche–bank-questioned…Representative Patrick McHenry, the top Republican on the House Financial Services Committee, sent a letter Thursday to CEO Christian Sewing, seeking documents that outline what internal and independent reviews have turned up about how the bank shields against illicit transactions. … who leads the financial services panel, and Adam Schiff of …

-

Dirty money fears push Deutsche Bank into trans-Atlantic …

https://http://www.politico.com/story/2019/02/04/dirty-money-fears-push…Rep. Patrick McHenry (R-N.C.), the top Republican on the House Financial Services Committee, has asked Sewing for details on the lender’s anti-money–laundering practices. “With Deutsche Bank …

Donald Trump’s former business partner is a part of this scheme and you guys think he’s going to help us after hiring Wilbur Ross and Steve Mnuchin?? Please!

-

Money Laundering Schemes in Real Estate – Corporate …

https://www.corporatecomplianceinsights.com/money–laundering…-

The Global Illicit Financial Flows Report estimates that China, Russia and India are the top three countries receiving ill-gotten money moving out of the U.S. Chinese nationals are on the top of foreign buyers of the Australian real estate, with nearly $6 billion in 2013. Indians and Russians are among the largest non-Arab investors of real estate in Dubai. Between 2012 to 2014, Indians only invested more than 44 billion dirhams in the Dubai real estate market (more than US$12 billion).

-

Author: Ahmed Taimour

-

-

-

Best of 2016: Money Laundering Schemes in Real Estate …

Real estate is an established method of money laundering internationally; the Financial Action Task Force (FATF) has recognized that the real estate sector is a high-risk sector for money laundering, and it frequently attracts criminals who want to launder their dirty money.

-

Author: Ahmed Taimour

-

-

-

MONEY LAUNDERING IN THE COMMERCIAL REAL ESTATE …

https://http://www.fincen.gov/money–laundering-commercial-real–estate…MONEY LAUNDERING IN THE COMMERCIAL REAL ESTATE INDUSTRY. … The filer suggested this activity could be a money laundering scheme. 6. A U.S. bank reported that a Latin American business, which purportedly provides property management and representation services for an American business operating in a Latin American country, was also a money …

-

-

Real Estate | Money Laundering Watch

https://www.moneylaunderingnews.com/category/real–estateAnother Sprawling Money Laundering and Bribery Scheme Involving Venezuela: Currency Exchange Rate Manipulation, Rewarded By Aircraft, Real Estate, and Thoroughbred Horses

-

-

How money laundering works in real estate – Washington Post

https://http://www.washingtonpost.com/news/politics/wp/2018/01/04/how…How money laundering works in real estate. … The charges faced by a bank involved in a deal to launder money through real estate would be related to conspiracy. Same holds for a real–estate …

-

-

DIRTY MONEY: DEVELOPMENT, MONEY LAUNDERING, & REAL …

https://warroom.armywarcollege.edu/…/money–laundering-in-real–estateThe real estate sector has less regulatory oversight than other economic sectors and property enables its owners to carry out other kinds of money laundering schemes, involving cash purchases, complex loans, monetary instruments, mortgages, investment institutions, fraudulent appraisals, and anonymous corporate entities.

-

-

Anti-Money Laundering Guidelines for Real Estate …

https://www.nar.realtor/articles/anti-money–laundering-guidelines…-

The crime of money laundering continues to be a growing area of concern in the United States. Therefore, law enforcement agencies and the financial sector devote considerable time and resources to combatting these illegal financial activities. However, many non-financial businesses and professions are also vulnerable to potential money laundering schemes.Real estate professionals are a category of the non-financial business sector that may encounter persons engaging in money laundering activi…

-

-

-

How To Launder Drug Money: Start An LLC And Buy Real Estate

https://www.mintpressnews.com/how-to-launder-drug-money-start-an…How To Launder Drug Money: Start An LLC And Buy Real Estate . An explosion in cash-only home sales reveals a possible loophole in laws designed to prevent money laundering.

-

-

https://http://www.fincen.gov/sites/default/files/shared/MLR_Real_Estate…

Residential real estate-related money laundering is often associated with mortgage loan fraud.2 This connection is understandable since money launderers may engage in mortgage loan fraud to promote laundering through residential real estate. Both money launderers and fraudsters engaged in mortgage loan fraud to reap illicit profits

-

-

How is money laundering done through real estate? – Quora

https://www.quora.com/How-is-money-laundering-done-through-real-estateReal estate sales that involve shell companies like limited liability companies, often known as L.L.C.s; partnerships; and other entities. A real estate transaction can be used in any one of the the stages of money laundering.

-

-

AMLA | Deutsche Bank Faces Growing U.S Scrutiny Over Money …

https://theamla.com/news/deutsche–bank-faces-growing-u-s-scrutiny…Jan 25, 2019 · Deutsche Bank AG is facing broadening U.S. scrutiny as a leading Republican lawmaker joined Democratic colleagues in questioning the company’s steps to combat money–laundering amid reports that its U.S. unit may have been a key conduit for dirty cash.

-

Author: Jon Mcgauley

-

-

Maxine Waters: “Deutsche Bank Is Perhaps The Biggest Money …

https://http://www.zerohedge.com/news/2019-02-01/maxine-waters-deutsche…

Maxine Waters: We know that Deutsche Bank is one of the biggest money laundering banks in the country, or in the world perhaps. And we know that this is the only bank that will lend money to the president of the United States because of his past practices.

-

Police raid Deutsche Bank offices in money laundering case

https://www.apnews.com/06e3b8b7d0e94f37ac4186de786ecb21

Deutsche Bank confirmed the search and said “the investigation has to do with the Panama Papers case.” “More details will be communicated as soon as these become known. We are cooperating fully with the authorities,” the bank said. Money laundering has become a growing problem in Europe, where a series of scandals has exposed lax …

Deutsche Bank sinking after another raid amid money …

Deutsche Bank offices in London seen in 2013. REUTERS/Luke MacGregor. Deutsche Bank‘s offices in Frankfurt, Germany, were raided again Friday in connection to the Panama Papers-related money–laundering investigation.

Deutsche Bank

By Philip Mattera

Deutsche Bank’s position as one of the world’s leading financial institutions has been repeatedly tarnished in recent years in a series of scandals involving issues such as tax evasion and the sale of toxic mortgage securities. It has paid more than $3 billion in penalties related to allegations of violating U.S. economic sanctions and manipulating the LIBOR interest rate index.

Founded in Berlin in 1870, Deutsche Bank played a major role in financing electrification and railway expansion in Germany as well as other countries. It continued to grow until Germany’s defeat in the First World War and Allied demands for reparations put the country’s banking system in a precarious position. To cope with the instability, Deutsche Bank merged with its main rival Disconto-Gesellschaft in 1929. The combined operation, now far and away the leading bank in Germany, weathered the Depression and ensured its political survival through the war years by providing financial support to the Nazi regime and removing the Jewish members of its board directors.

After the war, Allied authorities determined that Deutsche Bank had not only actively supported the Nazi regime but had also maintained close ties to officials such as SS chief Heinrich Himmler and had been involved in appropriating assets of financial institutions in countries overrun by the Nazis. The occupying forces divided the bank first into ten and then three regional institutions, one each for the north, central, and southern regions of West Germany. In 1957, however, the operations were reunited and allowed to function under the Deutsche Bank name once again.

The bank set out to build both its retail business and its international operations, which had been dismantled after the war. It became one of the leading participants in the Eurobond market. Deutsche Bank expanded its investments in a wide range of German companies, and the bank soon held seats on the supervisory boards of more than 100 firms, among them the biggest names in German industry. In 1984 Deutsche Bank purchased a 4.9 percent interest in the British securities firm Morgan Grenfell, and five years later purchased the remainder of the firm.

By the late 1980s Deutsche Bank was actively pursuing a goal of becoming a global investment bank and a Europe-wide universal bank, offering corporate and consumer services as well as mutual funds and asset management. The bank demonstrated its new assertiveness in 1990, when it wasted no time taking advantage of the collapse of Communism in East Germany by forming a joint venture with Deutsche Kreditbank (which four decades earlier had expropriated many Deutsche Bank operations). Along with its rival Dresdner Bank, Deutsche Bank left U.S. banks in the dust in the rush east.

Nazi Collaboration Again an Issue

Deutsche Bank’s Nazi ties became an issue again in 1986, when it purchased the Flick industrial empire around the same time that a Flick subsidiary paid about $2 million to belatedly fulfill a pledge it had made in the 1960s to compensate about 1,300 Jews who had been used as slave laborers in its gunpowder factories during World War II. In 1995 unearthed documents from East Germany provided new documentation of the ways in which Deutsche Bank helped the Nazis expropriate Jewish businesses. The bank later expressed regret when a historian’s report indicated that it had engaged in gold transactions with the Nazi regime.

In 1994 Deutsche Bank found its image tarnished because of its close ties with the giant Jurgen Schneider real estate group, which collapsed amid reports of accounting irregularities. Several Deutsche Bank executives were ousted in the wake of an auditor’s report that found that the bank was careless in its lending of some $750 million to Schneider.

To advance its goal of becoming a global investment bank, Deutsche Bank announced plans in 1998 to acquire New York-based Bankers Trust. Like Deutsche Bank, Bankers Trust was testing the limits of what a commercial bank could do, but its aspirations were impeded by a series of scandals. In the mid-1990s those controversies stemmed from charges of deceptive investment sales practices. One of its major institutional customers, Procter & Gamble, brought a racketeering suit that accused Bankers Trust of engaging in fraudulent practices in its derivatives business. (The bank settled the case for about $200 million.)

Just a few months after the Deutsche Bank acquisition was announced, Bankers Trust pleaded guilty to criminal charges that its employees had diverted $19 million in unclaimed checks and other credits owed to customers over to the bank’s own books to enhance its financial results. The bank paid a $60 million fine to the federal government and another $3.5 million to New York State. One executive later pleaded guilty to a related criminal charge.

Abusive Tax Shelters

Deutsche Bank was also having its own legal problems during this period. In June 1998 its offices were raided by German criminal investigators looking for evidence that the bank helped wealthy customers engage in tax evasion. In 2004 investors who purchased what turned out to be abusive tax shelters from Deutsche Bank sued the company in U.S. federal court, alleging that they had been misled (the dispute was later settled for an undisclosed amount). That litigation as well as a U.S. Senate investigation brought to light extensive documentation of Deutsche Bank’s role in tax avoidance.

In the 2000s, Deutsche Bank was cited numerous times by financial regulators for violations. In 2002 three U.S. agencies—the SEC, the New York Stock Exchange and NASD (the U.S. industry regulator now known as FINRA)—fined Deutsche Bank Securities $1.65 million for failing to adhere to requirements relating to the preservation of e-mail archives so they could be consulted in enforcement actions. In 2003 the SEC penalized Deutsche Bank $750,000 for violating conflict of interest rules by failing to disclose its role in advising Hewlett-Packard on the acquisition of Compaq Computer at the same time that its asset management arm was voting its clients’ proxies in favor of the deal.

In 2004 Britain’s Financial Services Authority fined Deutsche Bank’s Morgan Grenfell unit £190,000 for violating rules relating to program trading. Shortly thereafter, NASD fined Deutsche Bank $5.29 million for taking excessive commissions in the allocation of shares of initial public offerings and later that year fined the bank $5 million for corporate high-yield bond trading violations. Also in 2004, the SEC announced that Deutsche Bank would pay $87.5 million to settle charges of conflicts of interest between its investment banking and its research operations.

In 2005 the Federal Reserve and the New York State Banking Department announced that Deutsche Bank had agreed to take steps to improve its policies designed to prevent money laundering by customers. In 2006 the Financial Services Authority fined Deutsche Bank £6.3 million for “failing to observe proper standards of market conduct” in transactions involving shares of Scania and Cytos Biotechnology. That same year, Deutsche Bank agreed to pay $208 million to U.S. federal and state agencies to settle charges of market timing violations.

During this period, Deutsche Bank chief executive Jose Ackermann personally paid 3.2 million Euros to settle criminal charges that he and other directors of the German telecommunications company Mannesmann awarded excessive bonuses to Mannesmann executives.

In 2007 Deutsche Bank agreed to pay $25 million (and give up $416 million in unsecured claims) to settle litigation relating to its dealings with bankrupt energy trader Enron Corporation.

In 2009 the SEC announced that Deutsche Bank would provide $1.3 billion in liquidity to investors that the agency had alleged were misled by the bank about the risks associated with auction rate securities. Also that year, Deutsche Bank came under sharp criticism in the wake of revelations that it had used a private detective to spy on activist investors as well as some people inside the bank. Several executives were fired amid the scandal.

In 2010 FINRA fined Deutsche Bank Securities $575,000 for violating rules relating to short sales and then $7.5 million for “negligently misrepresenting delinquency data” in connection with the subprime mortgage securities.

Later that year, the U.S. Attorney for the Southern District of New York announced that Deutsche Bank would pay $553.6 million and admit to criminal wrongdoing to resolve charges that it participated in transactions that promoted fraudulent tax shelters and generated billions of dollars in U.S. tax losses.

In July 2014 the U.S. Senate Permanent Subcommittee on Investigations accused Deutsche Bank and Barclays of helping hedge funds use dubious financial products to avoid paying more than $6 billion in taxes.

In December 2014 federal prosecutors brought suit alleging that Deutsche Bank had fraudulently used shell companies to evade taxes on a transaction that had taken place in 2000. The suit claimed that the bank owed the federal government $190 million in taxes, penalties and interest.

Dealing in Toxic Securities

In 2011 the Financial Services Authority fined Deutsche Bank’s DB Mortgages unit £840,000 for “irresponsible lending practices and unfair treatment of customers in arrears”; the agency also secured redress of approximately £1.5 million for DB Mortgages’ customers. That same year, a German appeals court ruled that Deutsche Bank had to compensate a small-business customer for losses incurred as the result of an interest-rate swap. The court concluded that the bank had a “grave conflict of interest” in its dealings with the customer. Also in 2011, the Federal Housing Finance Agency sued Deutsche Bank and other firms for abuses in the sale of mortgage-backed securities to Fannie Mae and Freddie Mac (the case was settled for $1.9 billion in late 2013).

In 2012 U.S. Attorney for the Southern District of New York announced that Deutsche Bank would pay $202.3 million to settle charges that its MortgageIT unit had repeatedly made false certifications to the U.S. Federal Housing Administration about the quality of mortgages to qualify them for FHA insurance coverage.

In late 2012 and early 2013 there were reports that Deutsche Bank was being investigated by U.S. prosecutors for violating sanctions against doing business with countries such as Iran and by prosecutors in several countries for participating in the efforts to manipulate the LIBOR interest rate index. At the same time, German authorities were stepping up an investigation of the bank’s role in tax evasion linked to carbon credits. Deutsche Bank’s offices were raided by prosecutors in late 2012 as part of the probe.

In January 2013 Deutsche Bank agreed to pay a $1.5 million fine to the U.S. Federal Energy Regulatory Commission to settle charges that it had manipulated energy markets in California in 2010.

In February 2013 the bank had to delay the publication of its annual report and call an extraordinary shareholder meeting to respond to challenges by shareholders angry about the company’s legal problems.

In March 2013 Massachusetts fined Deutsche Bank $17.5 million for failing to inform investors of conflicts of interest during the sale of collateralized debt obligations.

In December 2013 Deutsche Bank was fined $983 million by the European Commission for LIBOR manipulation. Later, in April 2015, it had to agree to pay $2.5 billion to settle LIBOR allegations brought by U.S. and UK regulators.

In February 2014 Deutsche Bank agreed to pay the equivalent of about $1 billion to settle a longstanding lawsuit in which the bank had been accused of contributing to the collapse of the Kirch media group in Germany.

In December 2014 FINRA fined Deutsche Bank Securities $4 million as part of a case against ten investment banks for allowing their stock analysts to solicit business and offer favorable research coverage in connection with a planned initial public offering of Toys R Us in 2010.

In May 2015 the SEC announced that Deutsche Bank would pay $55 million to settle allegations that it overstated the value of its derivatives portfolio during the height of the financial meltdown.

The following month, co-chief executives Anshu Jain and Jurgen Fitschen unexpectedly resigned, reportedly under pressure from German regulators unhappy with the way they handled the investigation into alleged manipulation of benchmark interest rates by bank employees.

In November 2015 the investigation of Deutsche Bank’s sanction violations resulted in payments of $200 million to New York State regulators and $58 million to the Federal Reserve.

In December 2016 Deutsche Bank agreed to pay a total of $37 million to settle allegations by the SEC and the New York Attorney General that it mislead clients about order routing.

In January 2017 the bank reached a $7.2 billion settlement of a Justice Department case involving the sale of toxic mortgage securities during the financial crisis.

That same month, Deutsche Bank was fined $425 million by New York State regulators to settle allegations that it helped Russian investors launder as much as $10 billion through its branches in Moscow, New York and London.

In March 2017 Deutsche Bank subsidiary DB Group Services (UK) Limited was ordered by the U.S. Justice Department to pay a $150 million criminal fine in connection with LIBOR manipulation. The following month, the Federal Reserve fined Deutsche Bank $136.9 million for interest rate manipulation and $19.7 million for failing to maintain an adequate Volcker rule compliance program. Shortly thereafter, the Fed imposed another fine, $41 million, for anti-money-laundering deficiencies.

LOOTING LAUNDERING AND CHURNING STOLEN TRILLIONS

Criminality a Business Model

ENOUGH IS ENOUGH

-

Looted Stupid – America’s Greatest Robbery of ALL TIME …

https://lootednation.wordpress.com/looted-stupid-americas-greatest…Judson Witham Mispression of Felonies, Cover Up The Great Texas Bank Job Fri Oct 29, 2004 10:59 207.160.231.7 If you are correct, and I have seen bigger surprises … Wholesale funding and the increase in construction bank …

-

Trillions Stolen …. America Looted | Trillions Looted …

https://lootednation.wordpress.com/aboutCentral Banks Now Own Stocks And Bonds Worth Trillions – And They Could Crash The … shape to handle an economic meltdown. … been displaying their looted goods … Michael Lewis : The Man Who Crashed the World – Vanity Fair

-

WikiLeaks a FRAUD … The Catbird’s Nest …. Trillions Looted

https://americalooted.wordpress.com/wikileaks-a-fraud-the-catbirds…Jun 16, 2000 · Vanishing Trillions; Judson Witham is NO Kidder; … What is truly amazing is the LOOTED TRILLIONS America is being MONSTROUSLY PLAYED YOUTUBE.COM I wrote Larry Klayman and GAVE YOU a Standing Ovation … Texas “The Bank Fraud – Obstruction of Justice- Judicial MAFIA Illegal Land Development and Secret Government Records Capitol of …

-

Judson Witham is NO Kidder | Trillions Stolen …… Looting …

https://americalooted.wordpress.com/judson–witham-is-no-kidderJudson Witham is NO Kidder TO ALL INVOLVED …. Lake Flushing and Electrical Power Generation and Moving vast amounts of SLUDGE to the bottom of Lake Champlain LEFT A HUGE BLOOD TRAIL.

-

Looted Stupid the missing American TRILLIONS on Vimeo

https://vimeo.com/162428493Bank Swindles and Dirt Dealing Land Speculation 101 CLINTONIAN STYLE BANK ROBBING ….. The TAYLOR BEAN AND WHITACKER METHOD ….. Beware of the Ranchero Racketeers and the Dirt Dealing KING OF ARIZONA.

-

Texas KING of Bank Looting and Land Fraud on Vimeo

https://vimeo.com/125155470Did you know? Help keep Vimeo safe and clean. Learn how to report a violation.

-

Judson Witham <jurisnot@***.com> 7:48… – The Clinton …

https://http://www.facebook.com/permalink.php?id=1449621838661081&story…I find it rather Odd seeing that Donald Clesson and Attorney Witson B. Etheridge and Thomas Eikel and yes even Attorney Robert L. Vickers testified against the Bank in Depositions ( See Witham Vs. Western Bank 1986-17930 Harris County 334th State District Court.

-

Occupy JAIL – Home | Facebook

https://http://www.facebook.com/pages/Occupy-JAIL/258632957514959Occupy JAIL. 510 likes. The Occupiers of The Republic are the Heroes of the coming Generations…Shock and Awe on The Corporate Usurptions NUKING The…

-

Earth Looted By The Money Changers – The Missing …

Oct 29, 1999 · The Great Texas Bank Job. … folks that is a $1.1 Trillion Dollar Looting of the American people Psssst, … How About it Ms. Reno is your answer LAND FRAUD ? FELONIOUS COLONIAS ANSWERS PLEASE !!!

-

CRIMINALLY CORRUPT – Eric Holder, Top DOJ Lawyers Were …

dailybail.com/home/criminally-corrupt-eric-holder-top-doj-lawyers…Jul 26, 2012 · @ Judson Witham We really can’t do any of your punishments publicly except sentencing them to prison and confiscating their wealth. Too much screaming and yelling and Pepper Spray, Tazers, and batons plus the people dispensing these punishments would be expensive.

-

Earth Looted By The Money Changers – The Missing …

Oct 29, 1999 · The Great Texas Bank Job. … folks that is a $1.1 Trillion Dollar Looting of the American people Psssst, … How About it Ms. Reno is your answer LAND FRAUD ? FELONIOUS COLONIAS ANSWERS PLEASE !!!

-

-

US BANK: Lawsuit to Take Aurora Woman’s House is …

4closurefraud.org/2013/05/17/us-bank-lawsuit-to-take-aurora-womans…May 17, 2013 · Lawsuit to take Aurora woman’s house is guaranteed, bank says. The owners of an Aurora woman’s mortgage said they absolutely will file a foreclosure lawsuit to take her house because of claims that Colorado’s public trustee process is unconstitutional.

-

-

CRIMINALLY CORRUPT – Eric Holder, Top DOJ Lawyers Were …

dailybail.com/home/criminally-corrupt-eric-holder-top-doj-lawyers…Jul 26, 2012 · @ Judson Witham We really can’t do any of your punishments publicly except sentencing them to prison and confiscating their wealth. Too much screaming and yelling and Pepper Spray, Tazers, and batons plus the people dispensing these punishments would be expensive.

-

-

David Dayen: Out of Control – New Report Exposes JPMorgan …

https://www.nakedcapitalism.com/2013/03/david-dayen-out-of-control…On Sun, Mar 17, 2013 at 8:56 AM, Judson Witham wrote: TRILLIONS have been LOOTED all the While The US Government Covered Up and Lined Their Pockets . The US Government are the CROOKS. TRILLIONS In Land and Banking Cons ALL Covered Up By The Government TOTAL TRASH. On Sat, Mar 16, 2013 at 9:54 AM, Jud Witham wrote:

-

-

The Shining Light: Benjamin Fulford – USA Looting Banks

shininglight2012.blogspot.com/2012/10/benjamin-fulford-usa-looting…Long Long Before Annonymous or Occupy or all the Fraudulent Forclouse Sites LONG BEFORE FaceBook existed ….. there was Judson Witham ….. The Land Fraud/Bank Looting Fighter …..

-

-

The Real Deal with Jim Fetzer podcast: Judson Witham

radiofetzer.blogspot.com/2012/03/judson-witham.htmlMar 28, 2012 · What is Truly amazing is The Over The Cliff Con and Hey all those FAKED PAPERS from LPS and DocX Huh ….. Funny Money and Faked Papers Huh. PS the 9 Trillion was the amount the Fed Reserve and Treasury couldn;t account for On Top of the 2.3 Trillion at the Pentagon + the 16 + TrillionPRINTED to Bail out the To Big To Fail …..

-

-

DRAIN THE SWAMP – BLACK OPS R US | The Adirondacks …

Sep 28, 2016 · … q=Speculation+Fraud+Bank+Looting+Land … q=toxic+zombie+illegal+subdivisions+land … TRILLIONS Have Been Swindled and … Videos of bank looting land speculation fraud

-

-

» Read the Foreclosure Documents Treasury Has Been Keeping …

4closurefraud.org/2012/11/08/read-the-foreclosure-documents…Nov 08, 2012 · Read the Foreclosure Documents Treasury Has Been Keeping Secret Posted by 4closureFraud on November 8, 2012 · 5 Comments Read the …

-

-

Operation Lone Star A Flood of Guns and Blood – Posts …

What a Wicked Web of the Looting of TRILLIONS The Great Texas Bank Job a blast from the past Panic in Paradise Vickers’ book, which calls for ending the secrecy of bank-examinati… Operation Lone Star A Flood of Guns and Blood

-

-

Comments on The Real Deal with Jim Fetzer podcast: Judson …

9 Trillion missing Pentagon and 9 Trillion Missing from Federal Reserve and what 30 Trillion Missing from Wall Street and the BANKS …..

-

-

IOLANI – The Royal Hawk: Whistleblower website and links

iolani-theroyalhawk.blogspot.com/2018/06/whistleblower-website-and…Jun 24, 2018 · Deep State the Vanishing of Trillions; FRAUD UPON THE COURT Harris County Tx 334th State District Houston; … Judson Witham (and Friends) have been … Oct 27, 2017 – I’ll Take Real Estate Swindling and Bank Looting for TRILLIONS Professor Black …

-

-

Banking Crimes- LIBOR, Fraudclosure and Money Laundering …

https://mattweidnerlaw.com/banking-crimes-libor-fraudclosure-and…Banking Crimes- LIBOR, Fraudclosure and Money Laundering- A Global Criminal Enterprise. In what world would a gang of criminal masterminds be permitted to meet in boardrooms all across this world and plan ways to steal billions….actually steal those …

-

-

Wiki-Freaks Connect the Dots – Posts | Facebook

Judson Witham: Testimonial: I have witnessed first hand the Great American Sell Out and the Lootingof America by Treasonous Persons and Entities over the past 40 years. … Trillions Looted. In Honor of Bobby Harmon and Laser Hass, etc etc Et Al Wiki Leaks is a GIANT SCAM and a Huge Fraud The DOJ and FBI Protect the VIRUS Sucks TESTICLES for …

-

-

IOLANI – The Royal Hawk: Vol VII No. 728 Part 3

iolani-theroyalhawk.blogspot.com/2018/11/vol-vii-no-728-part-3.htmlNov 09, 2018 · Bank Looting Trillions Stolen Land Fraud – Google Search. 1 1 Amelia Gora. Like. Like. Love. Haha. Wow. Sad. Angry. Comment. Comments. Write a comment… Judson Witham shared a link. Sp S on S so S red S · 1 hr. WHAT IF ??? THE SWAMP FOX is …

-

GAME OVER …. ALL THESE FINANCIAL CRIMES MUST BE CONFRONTED AND SPECIAL PROSECUTORS APPOINTED ….. The American People Have a RIGHT TO KNOW

- Home

- 18 Years AGO …. 11 Years BEFORE Occupy Wall Street

- About

- America Looted MUD & MONEY

- America Tortures It’s Inmates

- AMERICA’S NEVER ENDING CRIME SPREE

- BeWare The Smart Growth Eviro Socialist

- Bob Jensen’s History of Fraud in America “Mirrored”

- Churning – Laundering Money and the Subprime Daisy Chain Banksters

- Clinton Obama Bush the CIA and SLUSHY FUNDS … Clandestine Crimes – War Inc.

- Clintonian Dirt Flipping and Churning LAUNDERING MONEY With Dirt Deals the Realty of It

- Conroe and Houston Texas the Great CESSPOOL Of Land Swindles and Frauds

- Conservation Tactics Hardball & The NWO Agenda 22 Exposing Agenda 21

- Crooked Ass USA Inc. YOU BETCHA

- Deep State the Vanishing of Trillions

- Dirty Flippin Land Scams and Laundering GONE WILD

- FHA HUD FmHa VA Fannie Freddie and the DAISY CHAIN of Lootings

- FHA Scams HUD Frauds the Premier Paramount Pioneer Mortgage Funding CRIME SPREE

- FHFA The Whistle is Blown

- FRAUD UPON THE COURT Harris County Tx 334th State District Houston

- Get Swamp Draining You Bitches

- Gugno the Racket ….. Premier, Paramount, Pioneer JP Morgan Chase, Select Portfolio Servicing, Credit Suisse, Deutche Bank

- HUD / FHA / GAO / OCC / FBI / DOJ Open The Records a FOIA Demand

- INSIDE JOB … Vanishing Trillions

- Judson Witham is NO Kidder

- Land Flipping and Dirt Dealing 101 CLINTONIAN LAND SCAMMING The Dirt Dealing Guru’s Hand Book

- Land Scamming Texas Arizona Florida Saudi Arabia Arizona New Jersey California UTAH Style LETS TALK CLINTONIAN DIRT DEALING

- Land Speculation Paper Land Swindles on STEROIDS

- Land Swindles: A Cons Game to Beware Of

- LONG LONG Before the FIASCO of 2008

- Looting the World the Easy RICO Realty Way

- LOTS OF INDICTMENTS … Land & Bank Scams 101

- Magical Fantastic Texas Banksters

- Mega Money Laundry TEXAS

- New York State a very Shitty Record

- NOTICE TO THE UNITED STATES Inc. … A Tale of Frauds, Deception and Lootings … Money Laundering on Steroids

- Planetary Looting an INSIDE JOB … AKA Inverted Totalitarianism

- Q Anon, Occupy, ANON, David Ickes, Alex Jones, Matt Tabbi, The Looted Trillions LONG, LONG BEFORE YOU.

- Roger Stone BANKSTER WANNABE

- Russians MY ASS

- Stealing Trillions”THE LOW DOWN DIRT”

- SUBPRIME INTERNATIONAL MONEY LAUNDERING – 101 Cheating Bank Customers for Fun and Profit

- Subprime Money JP Morgan Chase Deutsche Bank and the Danske Bank MOBSTERS

- SUBPRIME Zombie Land Frauds and Bank Lootings FHA HUD FDIC FBI DOJ WTFU

- Subverted America – Reagan Bush Clinton Obama and THE COMPANY

- SWAMP DRAINING THE SEWER … Trillions Looted

- Targeting Land The NYS DEC Land Grabbers

- The CFPB and Just Us / FBI Rape America

- The CIA Murder of Don Bolles TRILLIONS VANISHING

- The GANG RAPE of America’s Financial System

- The LAND CONTRACTS Scams TEXAS Gone Wild

- The Murder of Rule 8 in the Federal KORTS … Death of the Jury Trial

- The Terrorists of the Beltway – DC goes completely ROGUE … The SLUSH FUNDS at State and The Foundation

- The ARKANSAS Development Skanks CLINTONS doing the DIRTY DEALS

- The Big Sleazy, The American People Rise From the Wood Shed Series

- The Clinton Gate State Foundation WEAPONS R US Inc. from Reagan Bush to Obama … War Incorporated

- The Financial Rape of America The Realty of It

- The GARGANTUAN PLANETARY Bank Job

- The Great Texas Bank Job

- The Great American Bank Jobs

- The Great American Manure Job

- The Great French, Dutch, Spanish, English YANKEE DOODLE Robberies Turtle Island Invasion and Occupation

- The Great Texas Bank Job … Reborn

- The HISTORY of DIRT DEALING Lootings Revealed

- The Houston CON / Mud Flats 101

- The Magical Vanishing TRILLIONS and the Trump Princess

- The TRIAD and Martin Harris’s Hat … SEER This Joe Smith … The Mormon MAFIA and the Deep State

- The Underbelly of Mortgage Fraud Cons

- The VANISHED Trillions – The Largest Heist in Human History

- TRILLIONS for FUBAR

- TRUMP OBAMA CLINTON BUSH and the Vanishing Trillions

- US District Judge Lynn Hughes an Open Letter to FBI Director Chris Wray … THE DEEP STATE

- US Mexican Border the Largest Bubbles and Mobsters in THE SWAMP

- Welcome to the Reservation “You SERFS” The Un-Affordable Crap Act and FIAT Trash Currency

- What actually Happened ( For the Complete Idiot )

- WikiLeaks a FRAUD … The Catbird’s Nest …. Trillions Looted

- Zombie Bastard Banksters DIRT DEALING for Trillions

- Zombie Toxic Assets …. Looting America the GET RICH QUICK WAY

Deutsche Bank to pay $95 million to end US tax fraud case – CNBC

Deutsche Bank to pay $95 million to end U.S. tax fraud case

Deutsche Bank offices raided for suspected carbon market …

German police raids Deutsche Bank offices in tax fraud probe

Deutsche Bank’s $10-Billion Scandal | The New Yorker

Deutsche Bank Offices Are Searched in Money Laundering …

Ex-Deutsche Bank Employees Sentenced in Tax Fraud Case

Deutsche Bank Settles U.S. Tax Fraud Case — MadCow

Deutsche Bank offices raided in money laundering probe

BEVERLY TRAN: Deutsche Bank Raided For Stealin’ From The …